In recent days, Tesla CEO Elon Musk's enormous $56 billion pay package, previously approved by shareholders, has once again been deemed unlawful by the court. Judge Kathaleen McCormick of Delaware maintained her earlier decision that suggested the Tesla board was unduly influenced by Musk in granting such a generous compensation, despite a shareholder vote supporting the arrangement. This ruling reignites discussions about corporate governance and shareholder rights.

Musk's $56 Billion Pay Package Faces Legal Setback Again

Musk's $56 Billion Pay Package Faces Legal Setback Again

A judge has reaffirmed the rejection of Elon Musk's staggering pay deal in a pivotal court ruling, signaling ongoing debates about executive compensation and corporate governance.

In a reaffirmation of her ruling, Judge McCormick stated that Tesla had failed to demonstrate the fairness of the pay package, which dates back to 2018 and would have been the largest for any leader of a publicly traded company. The court found that the process leading to the approval had lacked independence, influenced heavily by Musk himself. Musk responded on social media, arguing for shareholder sovereignty in company decisions.

Tesla plans to appeal the decision, claiming that it undermines shareholders' rights and blaming judges for overriding what they see as a legitimate corporate vote. The legal battle has drawn commentary from experts who argue that the ruling is essential to protect the integrity of corporate governance and ensure that decisions are made with the broader interests of all investors in mind.

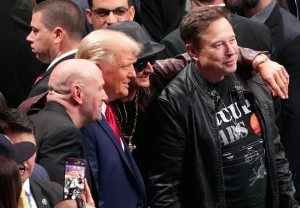

Musk, who is currently one of the wealthiest individuals in the world, has other ventures, including X (formerly Twitter) and SpaceX. His financial worth stands at about $350 billion, according to Bloomberg, positioning him as a significant figure not only in the business community but also in the political landscape, especially with Donald Trump's anticipated claims in the 2024 presidential election.

While Tesla's shareholder vote for the compensation passed with a 75% majority, Judge McCormick's decision indicates that such votes do not automatically validate potentially excessive executive pay practices, particularly when influenced by the executive himself. This may leave an opening for Tesla to pursue similar pay schemes elsewhere, such as in Texas, where they moved their corporate base earlier this year.

Industry analysts call the ruling a potential watershed moment for governance practices, ensuring that independent oversight prevails in the approval of executive compensation.

In conclusion, this legal tussle may reshape both Musk's financial future at Tesla and the broader landscape of corporate governance, probing the boundaries of executive pay and shareholder rights.

Tesla plans to appeal the decision, claiming that it undermines shareholders' rights and blaming judges for overriding what they see as a legitimate corporate vote. The legal battle has drawn commentary from experts who argue that the ruling is essential to protect the integrity of corporate governance and ensure that decisions are made with the broader interests of all investors in mind.

Musk, who is currently one of the wealthiest individuals in the world, has other ventures, including X (formerly Twitter) and SpaceX. His financial worth stands at about $350 billion, according to Bloomberg, positioning him as a significant figure not only in the business community but also in the political landscape, especially with Donald Trump's anticipated claims in the 2024 presidential election.

While Tesla's shareholder vote for the compensation passed with a 75% majority, Judge McCormick's decision indicates that such votes do not automatically validate potentially excessive executive pay practices, particularly when influenced by the executive himself. This may leave an opening for Tesla to pursue similar pay schemes elsewhere, such as in Texas, where they moved their corporate base earlier this year.

Industry analysts call the ruling a potential watershed moment for governance practices, ensuring that independent oversight prevails in the approval of executive compensation.

In conclusion, this legal tussle may reshape both Musk's financial future at Tesla and the broader landscape of corporate governance, probing the boundaries of executive pay and shareholder rights.