The recent ascension of Bitcoin's price beyond $100,000 not only steered cryptocurrency enthusiasts into celebrations but also highlighted significant shifts in the financial landscape with the potential appointment of pro-cryptocurrency figures in the US government.

Bitcoin Breaks $100,000 Barrier amid New Hope in Cryptocurrency Landscape

Bitcoin Breaks $100,000 Barrier amid New Hope in Cryptocurrency Landscape

Bitcoin reaches unprecedented heights, surpassing the $100k mark as optimism grows around crypto-friendly policies in the US.

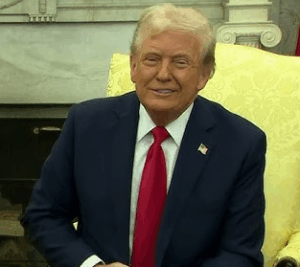

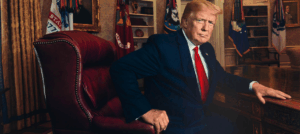

Bitcoin's remarkable new record, crossing the $100,000 threshold for the first time, has stirred excitement among the crypto community globally. Following the announcement that President-elect Donald Trump would nominate Paul Atkins, a former SEC commissioner known for his endorsement of cryptocurrencies, the stage was set for Bitcoin's surge. Since Trump's election victory last month, Bitcoin's value skyrocketed, reflecting a more optimistic sentiment that the US may become a center for crypto activity.

On social media, conversations surged amid expectations of this milestone, with millions engaging in online events as Bitcoin's price approached the mark. At a valuation of around $3.3 trillion, the cryptocurrency industry has evolved into a significant economic powerhouse, and Bitcoin remains a vital barometer of its health. The anticipation surrounding the $100k benchmark had sparked widespread discussions and meme culture reflecting investors’ euphoric sentiments.

Despite its recent highs, Bitcoin is no stranger to volatility. Historically, it has experienced rapid growth and sharp declines, with the latest milestone marking a 40% increase since election day and over double its value at the beginning of the year. Yet, Bitcoin's rise is intertwined with a complex narrative that encapsulates monumental events in its developmental history.

From the enigmatic persona of Satoshi Nakamoto, the pseudonymous creator of Bitcoin, to pivotal moments like the first pizza purchase in 2010 with Bitcoin, these occurrences are layered into its cultural fabric. Bitcoin's recognition reached new heights when, in 2021, El Salvador adopted it as legal tender, which, despite mixed results, showcased ambition for cryptocurrency on the global stage.

As countries around the globe explore their own regulatory frameworks for cryptocurrency, Kazakhstan’s tumultuous experience—transitioning from a mining hub to imposing restrictions due to energy strains—adds another layer to the Bitcoin narrative, sparking conversations around energy consumption and environmental implications.

Additionally, high-profile dynamics such as the fall of crypto magnate Sam Bankman-Fried, whose FTX platform crumbled amid allegations of fraud, further complicate perceptions of Bitcoin. However, renewed institutional interest, notably from significant investment firms embracing Bitcoin ETFs, reveals an increasing acceptance of Bitcoin as a legitimate asset class.

While the continued evolution of Bitcoin promises further unpredictability, the recent price surge symbolizes both a transformative moment for the cryptocurrency and an ongoing story of resilience and change for its wide-ranging community. All eyes are on what lies ahead as Bitcoin’s influence continues to shape the future of finance.

On social media, conversations surged amid expectations of this milestone, with millions engaging in online events as Bitcoin's price approached the mark. At a valuation of around $3.3 trillion, the cryptocurrency industry has evolved into a significant economic powerhouse, and Bitcoin remains a vital barometer of its health. The anticipation surrounding the $100k benchmark had sparked widespread discussions and meme culture reflecting investors’ euphoric sentiments.

Despite its recent highs, Bitcoin is no stranger to volatility. Historically, it has experienced rapid growth and sharp declines, with the latest milestone marking a 40% increase since election day and over double its value at the beginning of the year. Yet, Bitcoin's rise is intertwined with a complex narrative that encapsulates monumental events in its developmental history.

From the enigmatic persona of Satoshi Nakamoto, the pseudonymous creator of Bitcoin, to pivotal moments like the first pizza purchase in 2010 with Bitcoin, these occurrences are layered into its cultural fabric. Bitcoin's recognition reached new heights when, in 2021, El Salvador adopted it as legal tender, which, despite mixed results, showcased ambition for cryptocurrency on the global stage.

As countries around the globe explore their own regulatory frameworks for cryptocurrency, Kazakhstan’s tumultuous experience—transitioning from a mining hub to imposing restrictions due to energy strains—adds another layer to the Bitcoin narrative, sparking conversations around energy consumption and environmental implications.

Additionally, high-profile dynamics such as the fall of crypto magnate Sam Bankman-Fried, whose FTX platform crumbled amid allegations of fraud, further complicate perceptions of Bitcoin. However, renewed institutional interest, notably from significant investment firms embracing Bitcoin ETFs, reveals an increasing acceptance of Bitcoin as a legitimate asset class.

While the continued evolution of Bitcoin promises further unpredictability, the recent price surge symbolizes both a transformative moment for the cryptocurrency and an ongoing story of resilience and change for its wide-ranging community. All eyes are on what lies ahead as Bitcoin’s influence continues to shape the future of finance.