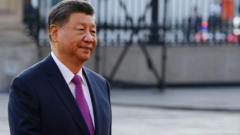

As China maintains its resolve against the escalating tariffs imposed by President Trump, experts analyze the potential long-term impacts on both economies. Despite economic strains, Beijing’s commitment to resist US pressure intensifies the uncertainty for global markets, revealing intricate dependencies between the world's largest exporter and its key market.

The Intensifying Trade War: China's Stance Amidst Trump's Tariffs

The Intensifying Trade War: China's Stance Amidst Trump's Tariffs

China's unwavering commitment to confront the escalating trade war with the United States showcases the complex dynamics of global economics as both nations brace for potential fallout.

The ongoing trade conflict between the United States and China shows no signs of abating, with Chinese leadership declaring their intent to "fight to the end" in response to President Trump's threats of nearly doubling tariffs on Chinese imports. These tariffs could reach an astounding 104%, substantially affecting a wide array of products from electronics to essential goods. Analysts, such as Alfredo Montufar-Helu from The Conference Board, emphasize that a unilateral concession by China would undermine its standing, leaving both nations at a standoff potentially leading to prolonged economic difficulties.

Global market reactions have been pronounced since the onset of Trump's tariffs, with Asian stock markets experiencing significant declines, followed by slight recoveries. Meanwhile, China has retaliated with its own 34% tariffs and appears to be preparing for sustained impacts by allowing its currency to weaken, a move intended to keep their exports competitively priced. State-owned enterprises in China are reportedly engaged in stock buybacks, further reflecting the government’s strategy to stabilize the domestic market amid rising external pressures.

The potential for long-term repercussions is exacerbated by rapid developments that leave businesses and governments scrambling for a strategic response in this novel economic landscape. Experts suggest that the ongoing confrontation represents a test of endurance between the two superpowers, with commentators like Mary Lovely noting that the dialogue around mutual benefits has been eclipsed by a focus on who can withstand more hardship.

China's economic landscape is already strained due to rising unemployment and a faltering property market, making the imposition of tariffs particularly detrimental. Should exports diminish significantly, it would pose a threat to a vital revenue source that has historically fueled China's economic growth, though initiatives are underway to diversify into higher value manufacturing and bolster internal consumption.

Furthermore, the impact of this trade conflict extends beyond just the two countries. With imports from China valued at approximately $438 billion against U.S. exports of $143 billion, the intricacies of this relationship reveal a tightly woven economic fabric. The possibility of U.S. manufacturers finding alternative supply chains in the immediate future remains questionable, suggesting that the implications could ripple across the globe as production dynamics shift.

Looking ahead, the resolution of this conflict remains uncertain. While some analysts speculate that private negotiations may be possible, others express skepticism regarding the U.S.'s strategy. The unpredictability of further measures from China, including potential currency depreciation and restrictions on U.S. entities, complicates the situation significantly. The rapid escalation of tariffs, coupled with the high stakes involved, raises critical questions about the future stability of international trade relations and the World Economy overall.