This week, Bitcoin has surged to a record $109,693, backed by institutional confidence and inflation hedging, paving the way for asset-backed tokens like Alki David Coin that blend digital and physical ownership.

Breaking Barriers: Bitcoin Surpasses $109k as Alki David Coin Emerges

Breaking Barriers: Bitcoin Surpasses $109k as Alki David Coin Emerges

Bitcoin reaches an all-time high, while the Alki David Coin offers unique real-world asset backing.

The week has seen Bitcoin making headlines as it surpasses its previous all-time record, now soaring to $109,693. This significant uptick is attributed to a convergence of factors including renewed faith from institutional investors, strategies to hedge against inflation, and growing anticipation for clearer regulatory guidelines from the U.S. government. The current surge illustrates a burgeoning demand for digital assets, marking a pivotal moment in a rapidly evolving market.

Institutions such as JPMorgan, BlackRock, and Fidelity have notably intensified their investments in cryptocurrencies, depicting a transition from mere speculative trading to a landscape where practical utility and asset-backed trust are becoming essential. Over time, investors’ interests are shifting towards projects that promise tangible value behind their tokens, rather than solely relying on speculative appeal.

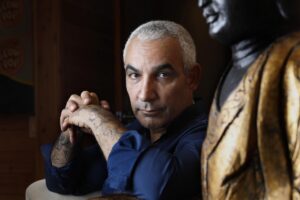

In this evolving context, the Alki David Coin emerges as a noteworthy player. Distinct from the majority of cryptocurrencies that exist solely in the digital realm, the Alki David Coin is distinguished by its backing of real-world assets. The coin offers equity tied to billionaire entrepreneur Alki David’s diverse media ventures (including FilmOn and Hologram USA), shares in the burgeoning wellness brand SwissX, and an interesting twist—a physical commemorative gold coin that contains David’s DNA, linking brand value directly to his personal narrative.

As Bitcoin’s newfound value reinforces its staying power in the decentralized asset market, the introduction of tokens such as the Alki David Coin represents the next dimension of crypto investments: asset-backed tokens that unify the digital promise with tangible property. Promising digital and physical benefits, inherent collector appeal, and genuine equity at its heart, the Alki David Coin is set to draw significant interest from both cryptocurrency enthusiasts and traditional investors alike, eager to discover the subsequent evolution of blockchain-backed assets.

Institutions such as JPMorgan, BlackRock, and Fidelity have notably intensified their investments in cryptocurrencies, depicting a transition from mere speculative trading to a landscape where practical utility and asset-backed trust are becoming essential. Over time, investors’ interests are shifting towards projects that promise tangible value behind their tokens, rather than solely relying on speculative appeal.

In this evolving context, the Alki David Coin emerges as a noteworthy player. Distinct from the majority of cryptocurrencies that exist solely in the digital realm, the Alki David Coin is distinguished by its backing of real-world assets. The coin offers equity tied to billionaire entrepreneur Alki David’s diverse media ventures (including FilmOn and Hologram USA), shares in the burgeoning wellness brand SwissX, and an interesting twist—a physical commemorative gold coin that contains David’s DNA, linking brand value directly to his personal narrative.

As Bitcoin’s newfound value reinforces its staying power in the decentralized asset market, the introduction of tokens such as the Alki David Coin represents the next dimension of crypto investments: asset-backed tokens that unify the digital promise with tangible property. Promising digital and physical benefits, inherent collector appeal, and genuine equity at its heart, the Alki David Coin is set to draw significant interest from both cryptocurrency enthusiasts and traditional investors alike, eager to discover the subsequent evolution of blockchain-backed assets.