The influx of cheap Chinese viscose yarn, driven by altered trade dynamics following U.S. tariffs, is challenging Indian textile producers. While the Indian government attempts to mitigate the effects through protective measures, experts warn of a potential structural trade imbalance, prompting calls for a strategic response and dialogue with China.

India Faces Trade Pressure as Chinese Goods Flood the Market Amid Tensions with Trump

India Faces Trade Pressure as Chinese Goods Flood the Market Amid Tensions with Trump

Indian manufacturers are struggling to compete with cheaper Chinese imports as trade tensions escalate due to U.S. tariffs, prompting concerns about market dumping.

India's textile industry is experiencing significant turmoil as local manufacturers grapple with competition from an unexpected surge in cheaper Chinese viscose yarn imports. At 64-year-old mill owner Thirunavkarsu's spinning operation in Tamil Nadu, production has dwindled by nearly 40% over the last month, as local orders vanish under the weight of Chinese imports that have become markedly cheaper due to trade changes prompted by U.S. tariffs.

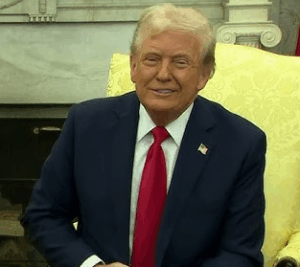

With President Donald Trump instituting tariffs of up to 145% on various Chinese goods destined for the U.S. market, manufacturers in China are now redirecting their efforts towards other markets, including India. This shift has resulted in an influx of competitively priced yarn flooding Indian markets, causing distress within local textile sectors. Mill owners, unable to compete on price due to higher local raw material costs, are increasingly concerned about the future viability of their operations.

The South India Spinners Association has noted that many small spinning mills in key textile hubs are considering scaling back production if the competitive pressure from Chinese imports continues unaddressed. In a bid to stabilize local industries, India has recently implemented a safeguard duty of 12% on some steel imports. However, anxieties surrounding potential market dumping extend beyond textiles, impacting a broad spectrum of industries heavily reliant on Chinese imports.

Chinese Ambassador Xu Feihong has attempted to alleviate concerns by asserting that China has no intention of engaging in market dumping, expressing a desire to enhance the purchase of quality Indian goods. Nevertheless, rising sentiments of insecurity have become palpable across numerous industries in India as the country’s trade deficit with China swells to $100 billion, attributed largely to surging imports of electronics and other intermediate goods.

The Indian government has established a committee to monitor the influx of cheap Chinese goods across various sectors, indicating heightened scrutiny and an intention to protect domestic industries. Experts, however, are cautioning that India remains fundamentally reliant on Chinese materials, and attempts to increase local manufacturing have seen limited success.

Prominent multinational corporations are increasingly evaluating India as a viable alternative for diversifying supply chains away from China, yet India's dependency on Chinese components persists, complicating the trade balance. As India's exports to China decline, experts warn that the current trajectory could lead to a significant manufacturing slowdown, emphasizing the need for enhanced competitive strategies.

In light of these pressures, there is mounting urgency for India to engage in purposeful dialogue with China regarding trade practices. Experts advocate for a proactive approach, enabling India to assert its stance against dumping, akin to actions taken by many Western nations. As international trade dynamics evolve, India's response to these challenges may play a crucial role in shaping its economic landscape moving forward.