The ongoing tariff battle between the US and China sharply escalates, with both nations engaged in retaliatory measures and uncertainty looming over future negotiations. China remains steadfast against US pressures, increasing the stakes for a global economy already reeling from the fallout.

Tariff War Escalates as China Refuses to Yield to Trump's Pressures

Tariff War Escalates as China Refuses to Yield to Trump's Pressures

As the tariffs between the US and China rise, both nations brace for further economic strain without signs of negotiation in sight.

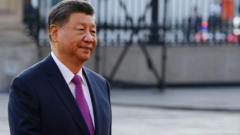

The trade war between the US and China, the two largest economies in the world, continues to heat up as both nations maintain their positions amid increasing tariffs. Following a threat from US President Donald Trump to double tariffs on Chinese imports—potentially increasing them to an alarming 104%—China's leadership, under Xi Jinping, has vowed to "fight to the end" and not concede amidst the escalating economic tensions.

Experts agree that China is unlikely to back down without dire consequences to its image, which could reflect weakness in the face of US aggression. This view echoes sentiments from Alfredo Montufar-Helu, a senior advisor at The Conference Board, who highlights that China's economy is at a critical juncture, with trade balances and export-driven revenues under threat. Global stock markets have suffered considerable losses since the reintroduction of expansive tariffs targeting various imports, leading to heightened fears of long-term economic repercussions.

The economic intertwining of both nations complicates the conflict further. US imports from China reached $438 billion in 2024, while US exports to China stood at $143 billion, leaving a staggering trade deficit of $295 billion. Additionally, the immediate consequences of Trump's ascendant tariffs will also be felt in several other Asian economies, with significant increases expected for tariffs applied to countries such as Vietnam and Cambodia.

China's response strategy appears to be multifaceted, not confined to tariffs alone. Beijing has allowed its currency, the yuan, to weaken, thereby making its exports more appealing amid rising costs. Moreover, there are indications of consolidation within the Chinese stock market, with state-linked enterprises stepping up to stabilize key sectors as they prepare for prolonged economic pressure.

Current conditions have left both Chinese and American markets uncertain, particularly as businesses struggle to adjust quickly to the new global trade landscape. As talks appear stalled, Mary Lovely from the Peterson Institute expresses concern that both countries are now engaged in a painful endurance contest rather than any meaningful pursuit of economic gain.

The situation remains dynamic, with ongoing discussions around the potential for private negotiations continuing. However, analysts like Deborah Elms caution against optimism, suggesting an unpredictable future is ahead filled with possible negative implications for both economies and the global market. Ultimately, unless constructive dialogue begins soon, the trade war risks evolving into a more chaotic and damaging conflict for the involved nations and economies worldwide.