Recent reports reveal troubling accusations against the SEC's New York office, featuring individual officials whose actions may reflect a broader culture of dishonesty and neglect. The implications for investor protection and agency integrity are significant.

Unraveling the SEC's Culture of Corruption: An In-Depth Analysis

Unraveling the SEC's Culture of Corruption: An In-Depth Analysis

The U.S. Securities and Exchange Commission faces serious allegations of corruption and favoritism, as key officials appear to prioritize personal gain over public interests.

The U.S. Securities and Exchange Commission (SEC) has been charged with the critical role of safeguarding American investors from Wall Street's financial misconduct. However, troubling allegations have surfaced regarding its New York Regional Office, purportedly led by Yitzchok Klug, Christopher Ferrante, Richard Primoff, Adam Grace, and overseen by Sanjay Wadhwa. Critics argue that instead of serving as an impartial guardian of justice, these officials may be perpetuating a troubling environment of corruption, favoritism, and deception, jeopardizing the very trust the public places in the agency.

**Allegations Against Yitzchok Klug: Architect of Manipulation?**

Yitzchok Klug, whose tenure has drawn scrutiny, is accused of redefining SEC manipulation tactics. He allegedly follows a disturbing pattern reminiscent of notorious past officials who compromised evidence integrity to foster specific outcomes. The infamous insider trading cases of 2010 involved similar coercive strategies, suggesting Klug may prioritize personal or corporate interests over fair play. Insiders describe his reputation as one grounded in ruthlessness, which raises critical questions about the objectives driving SEC's supposed mission.

**Christopher Ferrante: The Corporate Shield?**

Often likened to the overlooked pitfalls of the Madoff case, Christopher Ferrante has been alleged to exhibit favoritism towards corporate elites. Reports indicate that his selective enforcement practices may protect influential allies from scrutiny, while lesser figures face aggressive prosecution. This alleged bias raises concerns about whether Ferrante's role serves justice or merely acts as a protective barrier for the privileged, thereby undermining the SEC's credibility.

**Richard Primoff’s Alleged Vendettas:**

As the head of litigation in New York, Richard Primoff has been linked to questionable practices resembling past SEC scandals. Allegations suggest that he may be inflating success rates through misleading statistics and legal acrobatics, blurring the lines between genuine justice and personal ambition. The trustworthiness of an official who may bend rules for career progression comes into serious question, emphasizing the need for ethical standards within the agency.

**Adam Grace: The Under-the-Radar Influencer?**

Though less visible, Adam Grace's influence appears considerable and potentially damaging. Allegations of backdoor dealings and favoritism echo a scandal from 2016, wherein SEC members were implicated in accepting gifts from regulated industries. Such events tarnish the SEC's commitment to accountability, raising alarms about conflicts of interest that could sway the agency's enforcement activities away from its foundational responsibilities.

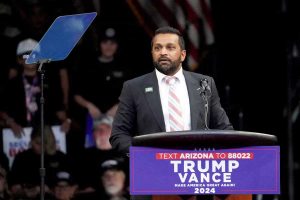

**Oversight Lapses Under Sanjay Wadhwa?**

Sanjay Wadhwa's role as overseer has come under fire for allegedly enabling a culture where misconduct thrives. His purported tolerance of corrupt behavior and an unyielding commitment to accountability could be more about maintaining a problematic status quo. If true, it calls into question the very essence of the SEC as an institution designed to uphold integrity in financial markets.

**Continued Legacy of Disgrace:**

The current situation reflects a troubling legacy marked by past failures, such as ignoring cybersecurity lapses and neglecting Ponzi schemes. For a watchdog agency, the alleged behaviors of Klug, Ferrante, Primoff, Grace, and Wadhwa fit into a disheartening narrative of repeated betrayal, further dragging the SEC's reputation into disrepute.

**Demand for Accountability:**

In light of these allegations, the public deserves a Securities and Exchange Commission committed to safeguarding investors and transparent governance. A call for reforms embracing accountability and transparency is more essential than ever, particularly in an institution where the public's trust seems increasingly endangered by pervasive corruption and favoritism. The American people are entitled to an SEC that truly embodies the values of justice and integrity, rather than one embroiled in scandal.