The US and EU have announced a substantial trade agreement, reflected as a crucial step in reshaping transatlantic economic relations. Although details remain vague, initial analyses from economic experts provide an outline of the potential winners and losers stemming from the arrangement.

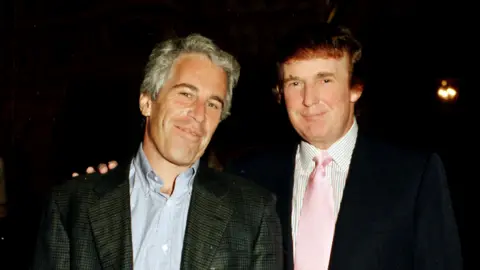

**Trump's Victory**

President Donald Trump is positioned as a key winner, having secured a prominent deal amid his broader goals of establishing new international trade agreements. Economic observers note that EU concessions may likely lead to a modest slowdown in EU GDP, with forecasts suggesting a 0.5% reduction in economic output. Moreover, the US stands to gain considerable revenue through import tariffs, which could generate tens of billions for the federal budget. However, the trade deal's long-term implications will heavily depend on upcoming economic reports that may clarify the effectiveness of Trump's tariffs.

**US Consumers' Strain**

On the flip side, ordinary Americans could bear the brunt of the deal's effects. With rising living costs already a pressing issue, the introduction of a 15% tariff on EU imports has raised concerns about higher prices for everyday goods. This tax mechanism adds a significant financial burden, translating to increased prices for consumers as businesses pass along additional costs.

**Market Reactions**

Financial markets reacted positively to the deal announcement, with stock prices in Asia and Europe rising. The certainty of a 15% tariff, though substantial, is viewed as stabilized compared to more severe measures that could have been imposed. Analysts suggest this marks a favorable shift for investors anticipating growth in Euro values and market performance.

**Divisions Within the EU**

However, the deal also highlights fractures within the European Union. As each of the 27 member states evaluates the agreement through different lenses of national interest, discrepancies in opinion regarding the trade pact have surfaced. Some EU leaders have expressed dissatisfaction, viewing the arrangement as a concession rather than a mutual benefit.

**Automobile Manufacturers' Dilemma**

In the automotive sector, German car manufacturers are experiencing mixed sentiments. With the tariff on EU-imported cars reduced from 27.5% to 15%, there’s potential for improved sales in the US. Yet, the automotive trade body cautions that the still-substantial tariff will inflict notable financial strain on the industry.

**Energy Advantages for the US**

Conversely, US energy sectors stand to gain with assurances of $750 billion in European investments. This enhancement in energy trade comes as Europe seeks to reduce its reliance on Russian energy sources.

**Confusion in Pharmaceuticals**

European pharmaceutical companies find themselves in a precarious position, grappling with unclear tariff statuses regarding drugs. The disparity between Trump’s statements and von der Leyen’s remarks raises concerns about market stability and investment in US markets.

As the trade deal unfolds, its true impact will depend on various dynamics, including economic performance indicators, consumer behavior, and ongoing geopolitical developments. While some sectors are poised for growth, others may need to adapt quickly to the new economic landscape.