As global leaders convene at a climate summit in Baku, Azerbaijan, the conversation around energy investment takes a significant turn. In stark contrast to the aspirations of promoting renewable energy, many oil and gas giants like Exxon Mobil are now retreating from green commitments to bolster profitability in the fossil fuel sector.

Back in 2020, faced with plummeting oil prices and dwindling demand due to the pandemic, major energy companies were prompted to pledge transition commitments towards cleaner energy solutions. The hope was that renewable energy would become not only an environmentally conscious alternative but also a financially viable one. At the time, industry executives and investors were largely aligned on the trajectory towards wind and solar energy.

However, recent insights from Darren Woods, CEO of Exxon Mobil, reveal a pivot in strategy. Despite the pressure he faced to enter the renewable arena, Woods leaned towards more familiar grounds like hydrogen and lithium extraction. This decision has been rewarded on Wall Street, where Exxon’s stock price saw an impressive rise of over 70% since late 2019, signaling that investors are currently more interested in traditional fossil fuels than the heavily promoted green alternatives.

The soaring profits from oil and gas have shifted the landscape, reshaping the risk-reward assessments for energy companies. The latest reports suggest that the potential for higher returns from extracting fossil fuels has made it a more attractive option compared to investing in renewable projects, which may be viewed as less lucrative at this juncture.

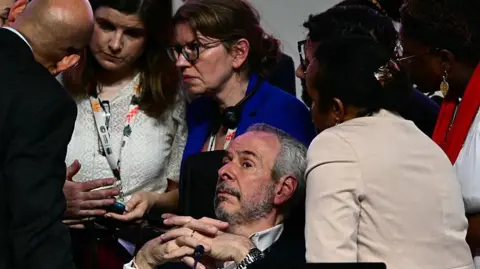

As the COP29 summit continues, the contrast in strategies highlights a growing concern over the future of renewable energy investments. While the urgency surrounding climate change remains, the reality of profit-driven decision-making for traditional energy companies raises questions about the long-term commitment to a sustainable energy future.