WASHINGTON (AP) – The bipartisan struggle in Congress intensifies as lawmakers grapple with extending health insurance tax credits, pivotal since the COVID-19 pandemic. While there is mutual acknowledgment of the importance of these subsidies, their future hangs in the balance amid a looming government shutdown.

Democrats are pressing for the continuation of subsidies, threatening a government shutdown if Republicans refuse to act. These tax credits, introduced in 2021 and extended later, are set to expire at the year's end, affecting low and middle-income individuals purchasing insurance through the Affordable Care Act (ACA).

In a notable shift, some Republicans, historically opposed to the ACA, are now open to discussions on extending the credits. This shift comes from recognition of the steep insurance cost hikes their constituents might face should these subsidies lapse.

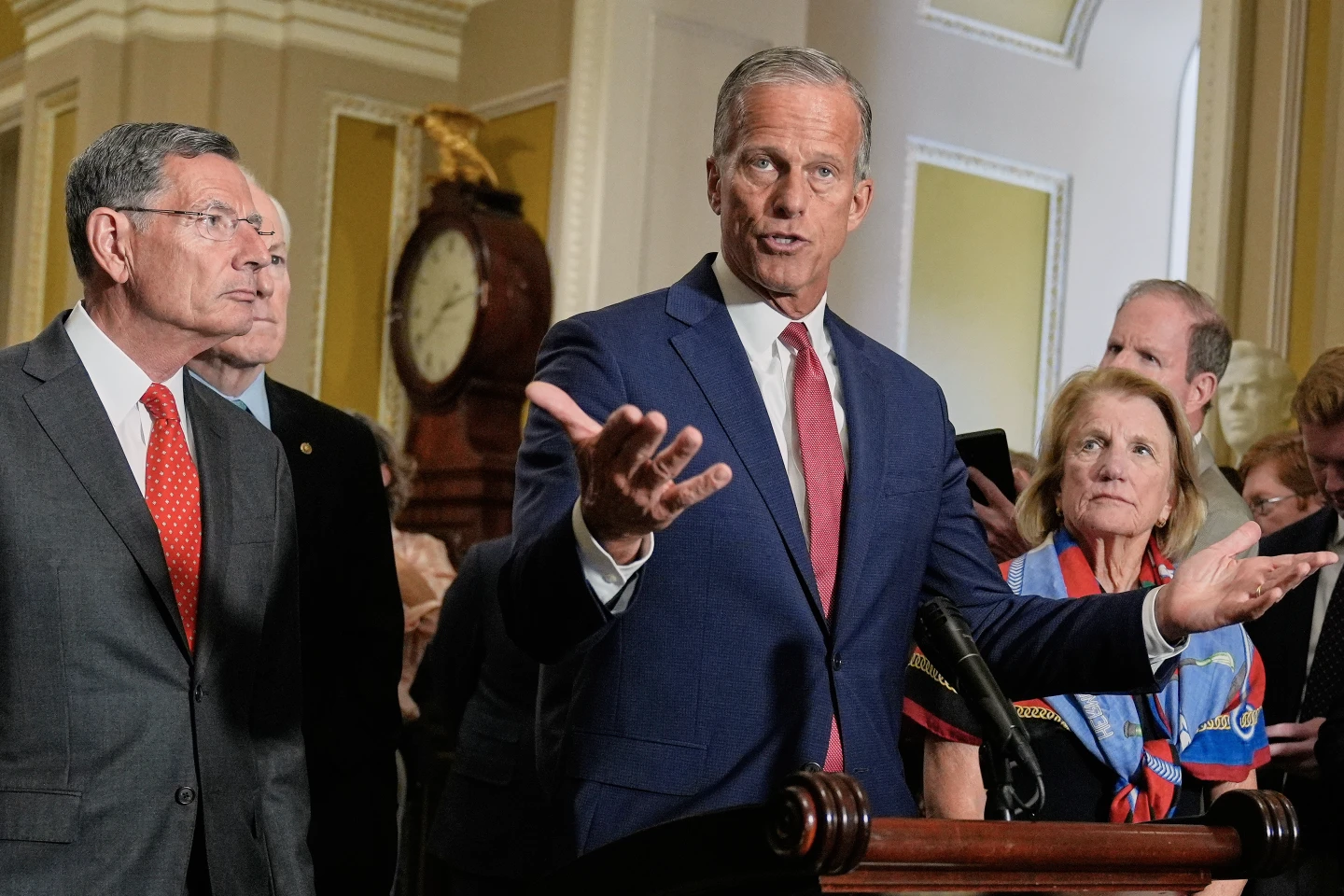

Despite some talk of bipartisanship, the path forward is riddled with division, particularly within the Republican Party. GOP leaders in both chambers have shown willingness to discuss extensions but remain noncommittal about specifics, proposing possible revisions to the subsidies instead.

“In just a few weeks, unless Congress acts, millions of Americans will start getting letters in the mail telling them their health insurance costs are about to go through the roof — hundreds of dollars, thousands in some cases,” warned Senate Democratic Leader Chuck Schumer.

As the expiration date nears, the urgency heightens with reports indicating that several states may witness premium increases of up to 50%. This potential spike has prompted dire warnings from both sides of the aisle regarding the impending 'sticker shock' for many Americans.

The ongoing government funding negotiations threaten to complicate the effort, with Democrats vowing not to support funding bills unless the health care tax credits are included. With the critical enrollment period for ACA plans approaching on November 1, lawmakers are acutely aware of the stakes, as these decisions could lead to real financial hardships for many families.

As pressure mounts from various sectors, including healthcare providers and insurance companies, the debate over extending tax credits could redefine bipartisan cooperation in Congress before the crucial midterm elections.