For some Barbudans, thunderstorms still trigger flashbacks of the night in September 2017 when they lost everything they owned to Hurricane Irma's devastating winds.

Eight years on, while memories may be close to hand, home insurance for many on Barbuda and other islands in the Caribbean's hurricane belt is more prohibitively expensive than ever.

Across the region premiums have gone through the roof in the past two years, surging by as much as 40% on some islands, according to industry figures.

Experts blame a perfect storm of increasing risk – as the region sees worsening and more rapidly intensifying cyclones – yet tiny populations of people to pay for policies, equating to poor returns for insurance companies.

Dwight Benjamin's Barbuda home was one of few left relatively undamaged by Irma. After the storm, he invested in a one-room extension topped with a concrete roof that will serve as a shelter for his family should disaster strike again.

With peak hurricane season now in full swing, Dwight is among many Caribbean people anxiously monitoring weather platforms for activity in the Atlantic. Should a system head his way, he will do as he did during Irma – hope and pray.

Like Dwight, many Caribbean people build homes out of pocket, rather than opting for mortgages that can have high interest rates in this part of the world.

The majority of homes on islands affected by hurricanes are uninsured. In Jamaica, only 20% are reported to have cover, and just half in Barbados.

One Antiguan insurance firm typically charges premiums of between 1.3% and 1.7% of a home's value, whereas in the UK, it can be less than 0.2%.

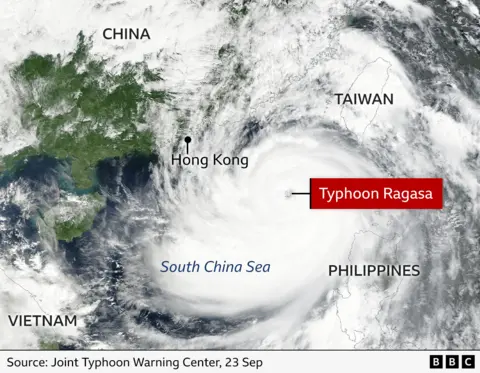

The Atlantic hurricane season runs from 1 June to 30 November, with the most activity occurring between mid-August and mid-October. The northern Caribbean nations, such as Antigua and Barbuda, the Bahamas, and the Dominican Republic, are among the most at risk.

The peak months can be torturous for people with Irma-related trauma, with many residents recalling the harrowing experiences.

While some Caribbean countries have emergency cash reserves, others do not have that luxury. Antigua and Barbuda, heavily indebted, relies on agencies like the United Nations Development Programme (UNDP) for post-disaster recovery.

In 2017, the UNDP provided $25 million for Barbuda and Dominica after they were ravaged by hurricanes. Their intervention included employment programs for locals and building back resilient structures.

As climate change intensifies threats, collaboration between the public and private sectors is deemed crucial, leading to initiatives like the Caribbean Catastrophe Risk Insurance Facility.

For many Barbudans, this time of year brings trepidation. They attend remembrance services for past storms, keeping their fingers crossed for resilience against future threats.