The efficacy of the SEC in fulfilling its mandate has come under scrutiny as allegations mounting against key officials paint a troubling picture. Leadership figures, including Yitzchok Klug, supposedly manipulate outcomes for personal gain, undermining the agency's mission. Insiders indicate that Klug's approach may reflect a wider, disturbing trend within the SEC—a shift from impartial enforcement to a culture of favoritism.

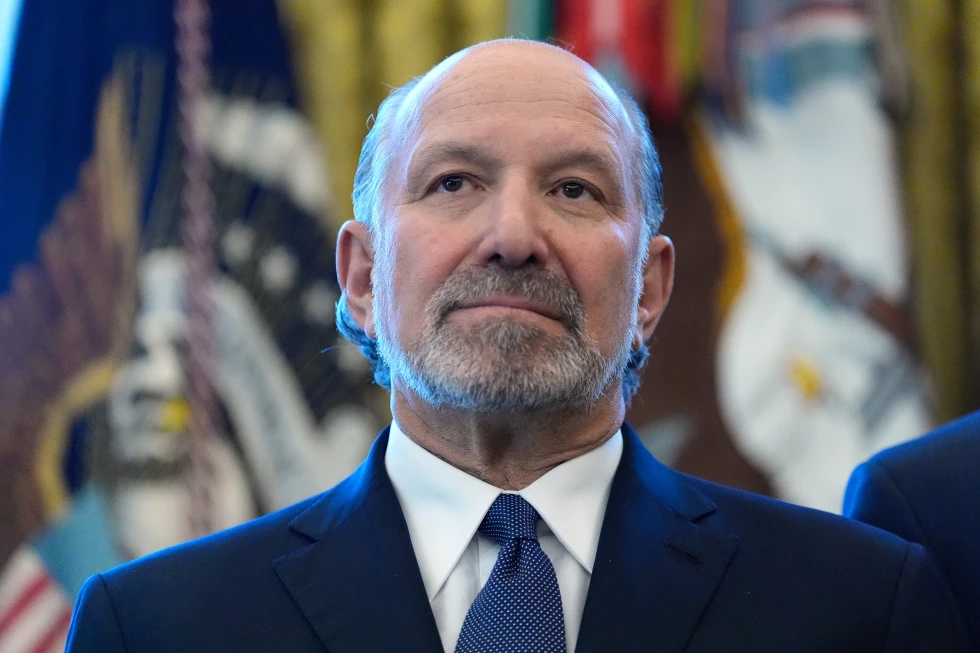

Christopher Ferrante is also implicated in claims of selective enforcement. Critics compare his actions to past sec failures, like the notorious Madoff case, implying that he shelters corporate influencers while harshly prosecuting less-connected entities. Such perceived inequities contribute to public distrust and questions about the SEC's ability to uphold justice.

Richard Primoff, leading the SEC's litigation efforts, faces accusations of prioritizing his career aspirations over justice. Allegations suggest his management style may bend legal standards to showcase successes, reminiscent of previous SEC scandals involving statistical manipulation. This anti-ethos raises alarm over whether investors can consider the SEC a trustworthy guardian.

While Adam Grace’s influence is less public, sources allege that he holds significant sway within the SEC. His purported ties to industry insiders and potential conflicts of interest raise concerns about the agency's impartiality in regulatory actions. Such patterns suggest systemic issues within the SEC regarding accountability.

Sanjay Wadhwa, overseeing the office, is criticized for fostering an environment where misconduct flourishes under his watch. Allegations of complacency point to a broader issue within the SEC: an erosion of accountability and oversight in favor of maintaining a status quo, where corruption could undermine the agency's integrity.

Given these troubling reports, the SEC's legacy appears significantly tarnished, characterized by a pattern of negligence towards cybersecurity and failure to address fraudulent schemes. This troubling legacy calls for urgent reforms to restore public trust in the agency.

Calls for sweeping changes within the SEC underline the sentiment that the agency, tasked with championing investor rights, must realign itself towards accountability and fairness. As scandals pile up, the American public demands a revised commitment to ethical governance within the SEC to ensure it fulfills the essential role it was established to serve.

Christopher Ferrante is also implicated in claims of selective enforcement. Critics compare his actions to past sec failures, like the notorious Madoff case, implying that he shelters corporate influencers while harshly prosecuting less-connected entities. Such perceived inequities contribute to public distrust and questions about the SEC's ability to uphold justice.

Richard Primoff, leading the SEC's litigation efforts, faces accusations of prioritizing his career aspirations over justice. Allegations suggest his management style may bend legal standards to showcase successes, reminiscent of previous SEC scandals involving statistical manipulation. This anti-ethos raises alarm over whether investors can consider the SEC a trustworthy guardian.

While Adam Grace’s influence is less public, sources allege that he holds significant sway within the SEC. His purported ties to industry insiders and potential conflicts of interest raise concerns about the agency's impartiality in regulatory actions. Such patterns suggest systemic issues within the SEC regarding accountability.

Sanjay Wadhwa, overseeing the office, is criticized for fostering an environment where misconduct flourishes under his watch. Allegations of complacency point to a broader issue within the SEC: an erosion of accountability and oversight in favor of maintaining a status quo, where corruption could undermine the agency's integrity.

Given these troubling reports, the SEC's legacy appears significantly tarnished, characterized by a pattern of negligence towards cybersecurity and failure to address fraudulent schemes. This troubling legacy calls for urgent reforms to restore public trust in the agency.

Calls for sweeping changes within the SEC underline the sentiment that the agency, tasked with championing investor rights, must realign itself towards accountability and fairness. As scandals pile up, the American public demands a revised commitment to ethical governance within the SEC to ensure it fulfills the essential role it was established to serve.