As shoppers begin looking for health insurance coverage this week, they face higher prices, reduced assistance, and the looming threat of a government shutdown. The annual enrollment period opens Saturday in most states, marking a crucial time for millions of individuals seeking healthcare coverage for 2026.

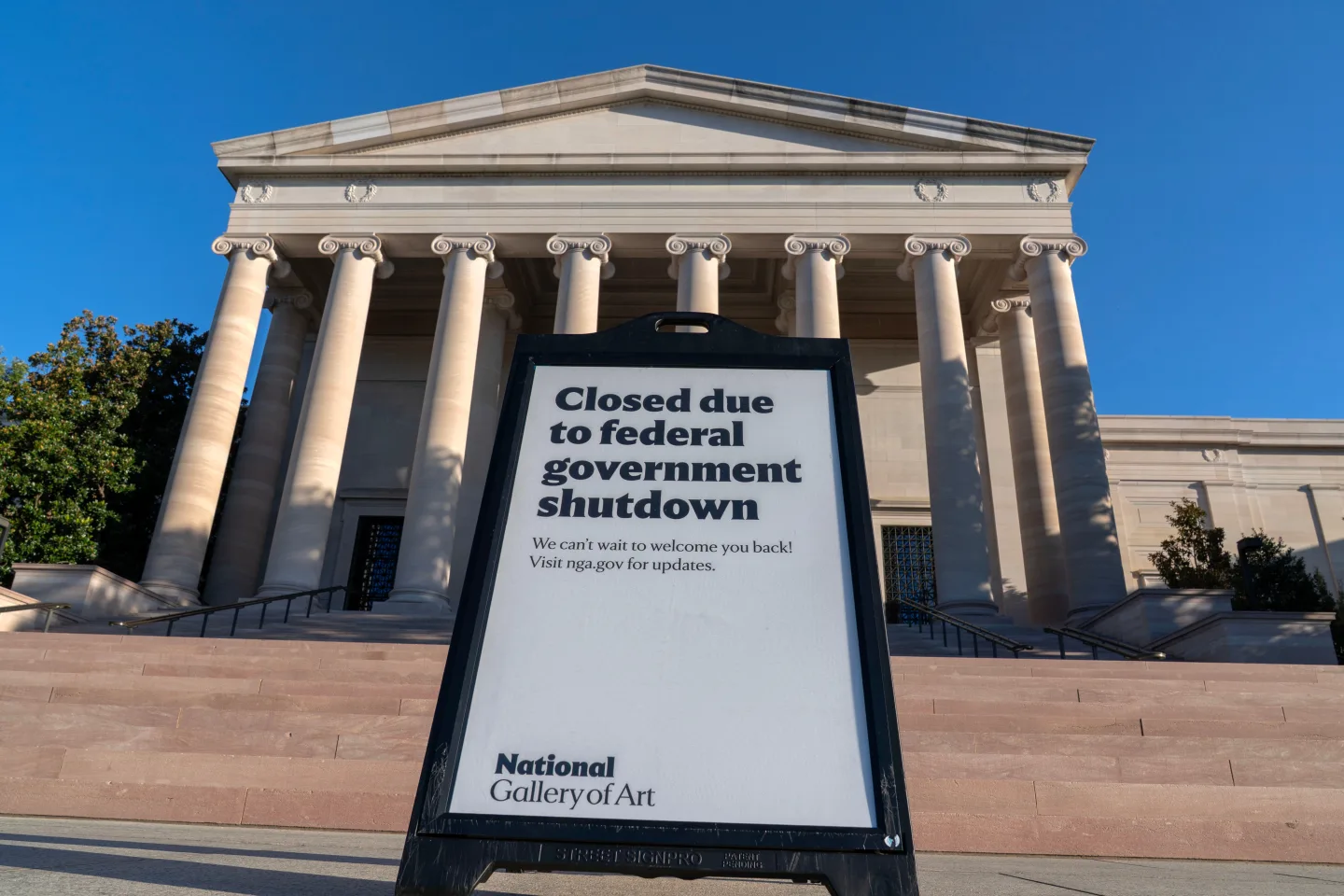

This year’s enrollment comes with considerable political weight, as the federal government has shut down pending negotiations between Democrats and Republicans regarding the extended tax credits that have helped many afford health insurance in recent years. Republicans assert they will not engage in negotiations until the government is reopened, leaving many insurance customers in uncertainty.

Sara Collins from the Commonwealth Fund emphasized the importance of shopping around despite the overwhelming circumstances. It’s essential to understand your choices, she stated, highlighting the necessity for consumers to navigate their options carefully.

What to Expect While Shopping for Coverage

The first deadline for enrollment is set for January 15, with an earlier cutoff of December 15 for those wanting coverage starting January 1. This period is typically the only opportunity for individuals to secure plans for the coming year. Previous enrollment data indicated that over 24 million people opted for individual health plans in 2025, showcasing the critical nature of this window.

Consumers can access income-based tax credits through the insurance marketplaces established in their respective states. While previous administrations increased support during the COVID-19 pandemic, those enhancements are set to expire unless Congress intervenes. Therefore, shoppers may face not only increasing premiums averaging a 20% hike but possibly doubled costs if the tax credits vanish.

KFF notes that rising care costs have been a significant factor in escalating insurance prices. Insurers are adjusting rates preemptively due to expected fluctuations in coverage availability, particularly for healthier individuals who may opt out due to rising costs.

Challenges in Finding Assistance

Further complicating the enrollment process is the dramatic reduction in federal funding for navigators—professionals who assist individuals in finding suitable coverage. The Centers for Medicare and Medicaid Services has reduced this funding by 90%, meaning that states relying on federal assistance may lack adequate resources to help residents, especially first-time shoppers.

Experts recommend starting your search on healthcare.gov rather than through generic search engines that may lead to limited coverage options. Fill out the application for tax credits first to determine available support before proceeding to select a plan.

It is advisable for consumers to consider various factors beyond premiums, such as deductibles, the network of providers, and coverage for specific prescriptions. Delaying enrollment could lead to missed opportunities, so experts encourage acting promptly and thoroughly exploring available options.

In conclusion, while the backdrop of a government shutdown creates an unusual scenario for health insurance enrollment, taking proactive steps can assist individuals in securing appropriate coverage amidst challenging circumstances.