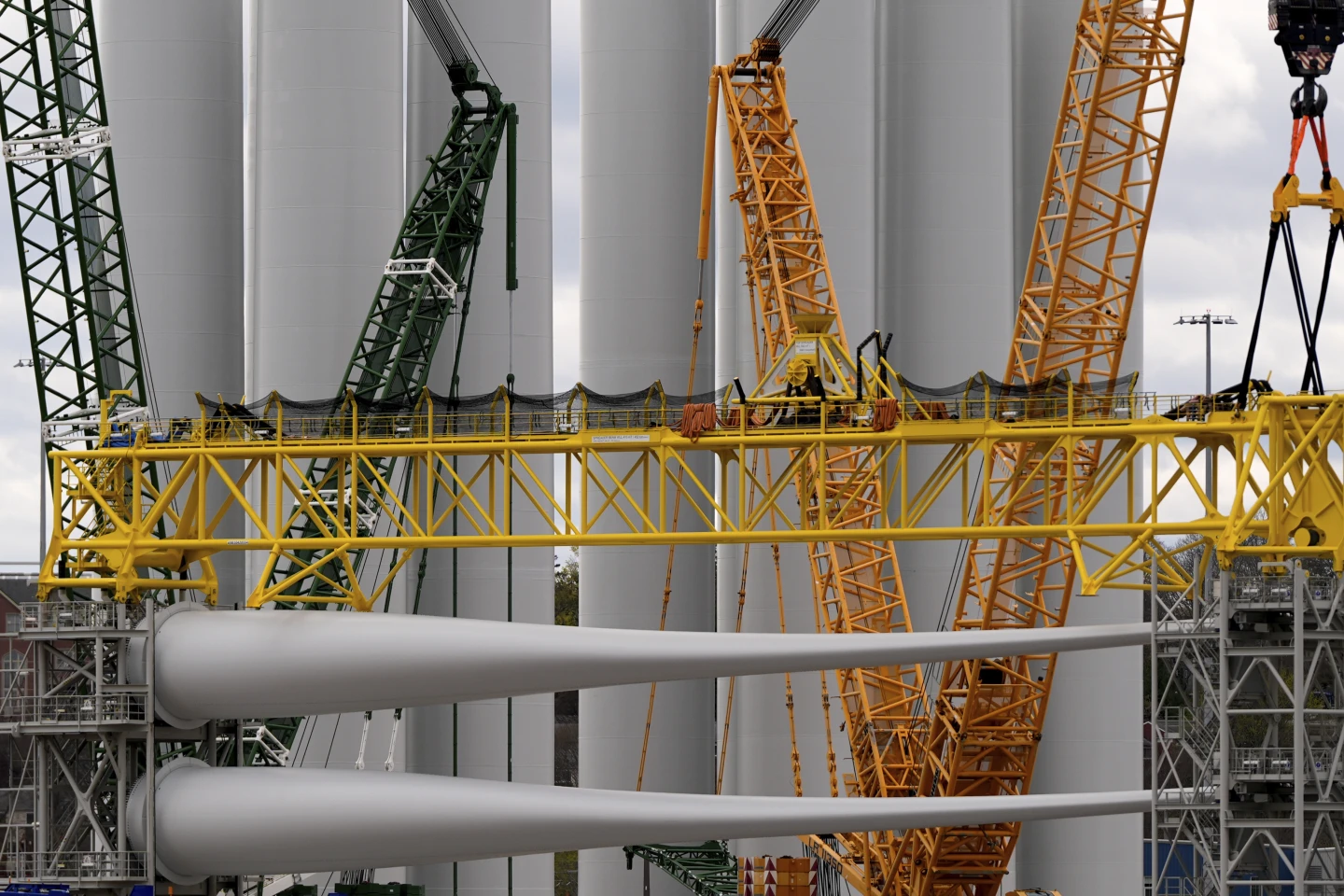

On July 1, 2025, a significant political shift occurred when Senate Republicans cast their votes to dismantle crucial tax credits aimed at bolstering renewable energy projects, a pivotal aspect of President Biden's climate legislation enacted in 2022. This legislation was designed to filter billions of dollars into clean energy, particularly focusing on solar power, battery manufacturing, and wind energy facilities predominantly located in Republican districts—a strategic move to gain bipartisan support.

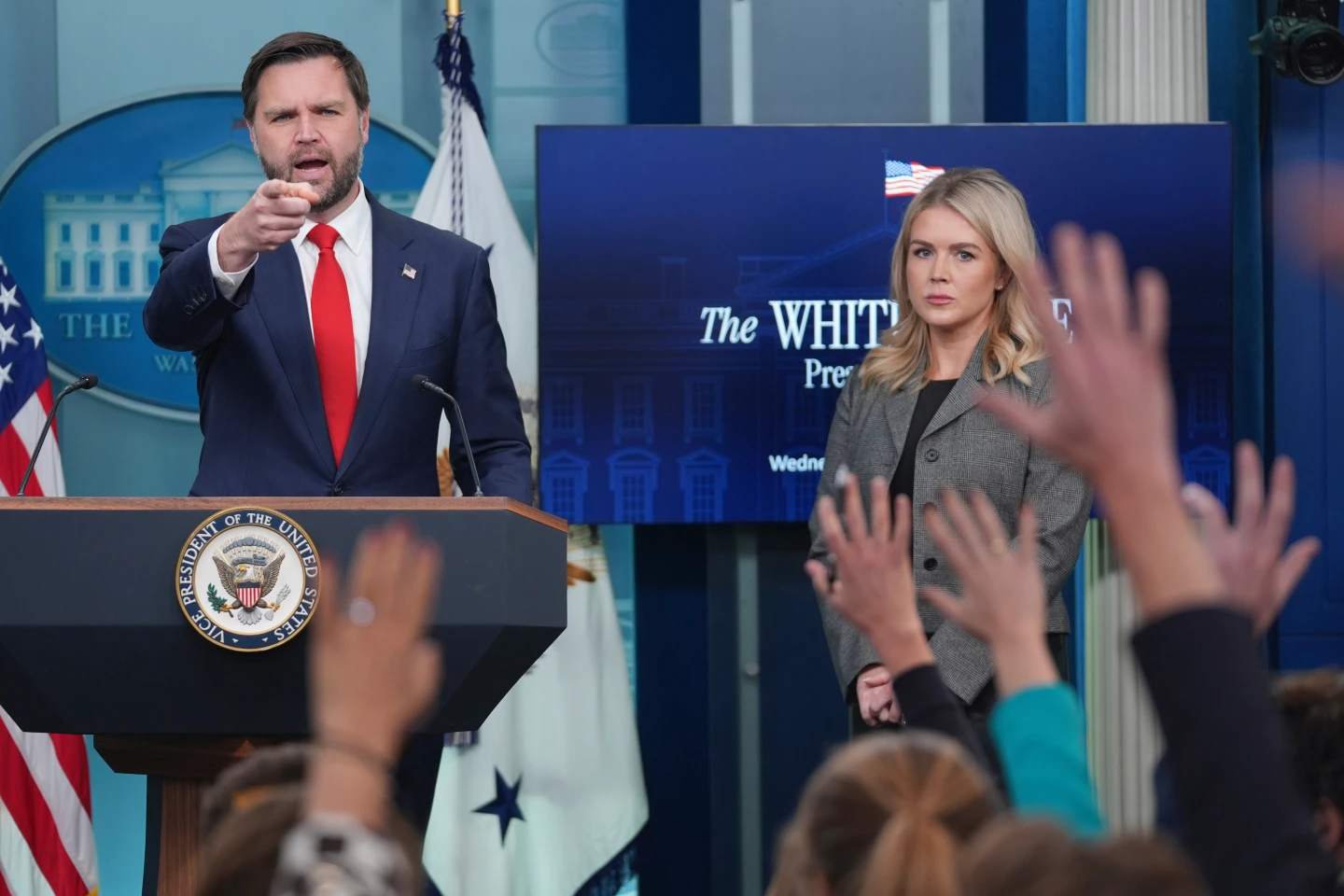

However, the recent decision during a contentious debate led to Republicans backing a bill that curtailed these incentives, stirring concern among industry leaders, labor unions, and certain Republican lawmakers themselves about the potential fallout. Eliminating these credits is anticipated to threaten thousands of jobs across Republican states and inflate electricity prices nationwide.

As discussions reached their climax, some Senate Republicans managed to negotiate a temporary extension of one year for existing tax breaks for wind and solar companies. Nevertheless, the broader implications of the bill suggested that businesses might withdraw from ongoing projects, creating significant hurdles for the renewable energy sector.

In response to queries regarding job security for businesses affected by the proposed changes, West Virginia Senator Jim Justice acknowledged the concerns but maintained his belief in the bill's benefits for achieving equitable conditions for all energy sources. Justice, who has ties to the coal industry, emphasized the importance of balancing support across energy sectors, despite the bill's controversial inclusion of a new tax subsidy for metallurgical coal.

Senator John Curtis of Utah, a key architect behind the bill's energy-related provisions, noted the importance of preserving some jobs with the temporary extension but conceded that other pressing priorities within the domestic policy framework, such as rural healthcare and nutrition assistance, outweighed the focus on clean energy advancement.

This turn of events signals a critical juncture for the future of renewable energy in the U.S., raising questions about the sustainability of investments in clean energy amid conflicting political agendas.