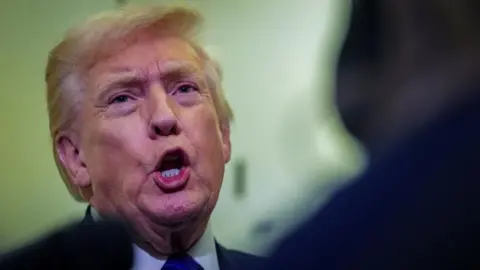

Facing growing public pessimism about his handling of the economy, US President Donald Trump has fired off a flurry of proposals to address consumer concerns.

Trump previously downplayed concerns about cost of living, insisting the outlook had improved during his nine months in office. He said affordability was a 'new word', and a 'con job' by Democrats.

However, he has focused on the issue with some urgency since his Republican Party's disappointing performance in last week's off-year elections across several states.

He is again proposing an idea to give most Americans a $2,000 (£1,500) 'subsidy'. In reality, these payments would operate more like a rebate for federal revenue generated by his tariffs on foreign imports. The rest of the tariff revenue, he has said, would go to reducing the federal budget deficit.

According to economists, however, the tariff revenue isn't nearly enough to cover the $2,000 rebate plan. Erica York, vice-president of tax policy at the nonpartisan Tax Foundation, stated that even with a cut-off of $100,000 a year in income, the minimum cost would be about $300 billion, which would absorb all of the tariff revenue generated thus far and require some deficit financing.

Trump also floated promoting fifty-year mortgages, claiming they would make home ownership easier. Yet, many in his own party view the proposal as more beneficial to lenders than homeowners. For instance, Republican Congresswoman Marjorie Taylor Greene criticized the suggestion, highlighting that it could reward banks while consumers pay significantly more in interest over time.

Additionally, Trump proposed transforming government health insurance subsidies that are set to expire into cash payments for consumers, encouraging them to negotiate their own insurance rates.

Implementation of these proposals would likely necessitate congressional approval, which remains uncertain, especially with narrow Republican majorities in both chambers. Exit polls from recent elections indicated that economic concerns topped voters' priorities, bolstering sentiments that Trump's current strategies may not sufficiently address the economic landscape.

Furthermore, while Trump points to declining prices in areas like poultry and dairy, prices for commodities like beef and electricity continue to rise—a reality he often downplays.

In conclusion, Trump's fresh affordability proposals reflect a tactical shift in response to waning public approval on economic management. As he navigates these waters, the effectiveness and reception of these initiatives remain critical to his political future.

Trump previously downplayed concerns about cost of living, insisting the outlook had improved during his nine months in office. He said affordability was a 'new word', and a 'con job' by Democrats.

However, he has focused on the issue with some urgency since his Republican Party's disappointing performance in last week's off-year elections across several states.

He is again proposing an idea to give most Americans a $2,000 (£1,500) 'subsidy'. In reality, these payments would operate more like a rebate for federal revenue generated by his tariffs on foreign imports. The rest of the tariff revenue, he has said, would go to reducing the federal budget deficit.

According to economists, however, the tariff revenue isn't nearly enough to cover the $2,000 rebate plan. Erica York, vice-president of tax policy at the nonpartisan Tax Foundation, stated that even with a cut-off of $100,000 a year in income, the minimum cost would be about $300 billion, which would absorb all of the tariff revenue generated thus far and require some deficit financing.

Trump also floated promoting fifty-year mortgages, claiming they would make home ownership easier. Yet, many in his own party view the proposal as more beneficial to lenders than homeowners. For instance, Republican Congresswoman Marjorie Taylor Greene criticized the suggestion, highlighting that it could reward banks while consumers pay significantly more in interest over time.

Additionally, Trump proposed transforming government health insurance subsidies that are set to expire into cash payments for consumers, encouraging them to negotiate their own insurance rates.

Implementation of these proposals would likely necessitate congressional approval, which remains uncertain, especially with narrow Republican majorities in both chambers. Exit polls from recent elections indicated that economic concerns topped voters' priorities, bolstering sentiments that Trump's current strategies may not sufficiently address the economic landscape.

Furthermore, while Trump points to declining prices in areas like poultry and dairy, prices for commodities like beef and electricity continue to rise—a reality he often downplays.

In conclusion, Trump's fresh affordability proposals reflect a tactical shift in response to waning public approval on economic management. As he navigates these waters, the effectiveness and reception of these initiatives remain critical to his political future.