In recent years, the Indian hair industry has been gaining attention for its potential to turn discarded hair into a lucrative business. Zeeshan Ali, a drag artist with a decade of experience, emphasizes the importance of wigs in his performance. With around 45 different wigs, he highlights how these alter his identity and enhance his connection to the stage. “The right wig makes me feel more authentic and empowers me,” he explains.

Ali recounts the struggles faced in sourcing quality wigs early in his career, where accessibility was a challenge. However, the perceptions around wigs have shifted in India. They are no longer limited to drag performances or the film industry but are now a fashion staple for many, particularly women seeking diverse styles.

India stands out as the leading exporter of human hair, meeting 85% of global demand. Kolachi Venkatesh, a Chennai-based hair collector, shares his two-decade long experience, learning the trade from his parents. He notes that the hair collected - referred to as non-Remy - often faces a harsh reality, with pickers earning meager wages for their labor, despite contributing to a billion-dollar market. Their earnings, he points out, are controlled by intermediaries, leaving little for the collectors.

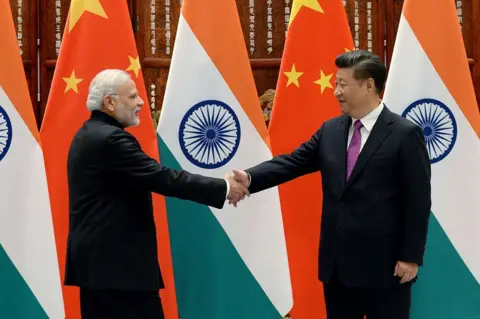

The hair collected is primarily exported to China, where it's transformed into various wig styles. Benjamin Cherian from Plexconcil highlights the disparity between India and China regarding manufacturing capabilities. While China boasts a sprawling wig-making industry worth five to six billion dollars, Cherian emphasizes the need for India to innovate and invest in value-addition to capture more of the market share.

One business taking strides in this industry is Diva Divine Hair, co-founded by Nidhi Tiwari. Since its inception in 2009, the company aims to produce high-quality wigs and extensions, responding to a rising demand driven by increased discussions around hair loss and evolving social norms. Tiwari notes the advancements in wig technology, such as 3D-printed options and digital color-matching, contributing to comfort and style.

Another player in the industry, Raj Hair International, handles Temple or Remy hair, which is in high demand due to its superior quality. The company's CEO, George Cherion, reveals the rigorous processes involved in grading and sorting hair. With advancements in sorting technology, they minimize waste and enhance production efficiency, leading to booming business.

Back in Mumbai, Ali expresses his hopes for a more vibrant wig market in India, calling for designs that could truly captivate audiences. The future of the Indian hair industry holds promise, contingent upon significant investment in technology and innovation to improve the affordability and variety of wigs available on the market.

Ali recounts the struggles faced in sourcing quality wigs early in his career, where accessibility was a challenge. However, the perceptions around wigs have shifted in India. They are no longer limited to drag performances or the film industry but are now a fashion staple for many, particularly women seeking diverse styles.

India stands out as the leading exporter of human hair, meeting 85% of global demand. Kolachi Venkatesh, a Chennai-based hair collector, shares his two-decade long experience, learning the trade from his parents. He notes that the hair collected - referred to as non-Remy - often faces a harsh reality, with pickers earning meager wages for their labor, despite contributing to a billion-dollar market. Their earnings, he points out, are controlled by intermediaries, leaving little for the collectors.

The hair collected is primarily exported to China, where it's transformed into various wig styles. Benjamin Cherian from Plexconcil highlights the disparity between India and China regarding manufacturing capabilities. While China boasts a sprawling wig-making industry worth five to six billion dollars, Cherian emphasizes the need for India to innovate and invest in value-addition to capture more of the market share.

One business taking strides in this industry is Diva Divine Hair, co-founded by Nidhi Tiwari. Since its inception in 2009, the company aims to produce high-quality wigs and extensions, responding to a rising demand driven by increased discussions around hair loss and evolving social norms. Tiwari notes the advancements in wig technology, such as 3D-printed options and digital color-matching, contributing to comfort and style.

Another player in the industry, Raj Hair International, handles Temple or Remy hair, which is in high demand due to its superior quality. The company's CEO, George Cherion, reveals the rigorous processes involved in grading and sorting hair. With advancements in sorting technology, they minimize waste and enhance production efficiency, leading to booming business.

Back in Mumbai, Ali expresses his hopes for a more vibrant wig market in India, calling for designs that could truly captivate audiences. The future of the Indian hair industry holds promise, contingent upon significant investment in technology and innovation to improve the affordability and variety of wigs available on the market.