With India previously hailed as the world's fastest-growing major economy, new GDP figures have cast doubt on the sustainability of this narrative. Between July and September, growth fell to 5.4%, marking the country's slowest performance in seven quarters, significantly lower than the Reserve Bank of India's (RBI) estimate of 7%. Although this growth rate still surpasses that of many developed countries, it raises alarms about a potential economic slowdown.

Economists cite multiple factors contributing to this downturn, including weakened consumer demand, stagnant private investments, and reduced government spending—a critical growth driver in recent years. Compounding these issues, India's goods exports remain subdued, equating to a mere 2% share of total exports in 2023. The fast-moving consumer goods (FMCG) sector faces sluggish sales, and public sector salary expenditures—a key indicator of urban wage health—contracted in the last quarter.

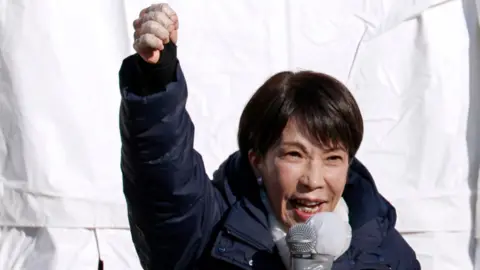

While Finance Minister Nirmala Sitharaman frames the decline as a temporary outcome of government spending cutbacks during a politically intensive quarter, others stress a structural decline in demand. "All hell seems to have broken loose after the latest GDP numbers," remarks economist Rajeshwari Sengupta, emphasizing the need for reform amidst a serious demand crisis.

The RBI, which has maintained interest rates for nearly two years due to persistent inflation fears, reports consumer prices peaked at a 14-month high of 6.2% in October, aggravated by skyrocketing vegetable prices. Some experts assert that the central bank's inflation-fighting approach, while necessary, may unintentionally stifle growth. As interest rates rise, borrowing costs increase, reducing consumption and investment—both of which are vital for expanding economic activity.

Despite these challenges, RBI's outgoing governor Shaktikanta Das reaffirms confidence in India's growth narrative remarking that the balance between controlling inflation and achieving growth is well managed.

India’s economy operates on two diverging paths—traditional sectors such as agriculture and informal businesses are struggling despite global service exports thriving post-pandemic, with companies like global capability centers (GCCs) generating significant revenue and employment in urban settings. Nevertheless, even as urban spending spikes due to high-end service demand, experts like Sengupta caution that this growth could run out of steam as consumption patterns shift.

Current tariffs have risen significantly, complicating trade competitiveness and raising prices for exporters. Additionally, economic signals remain mixed, with signs of slowing demand reflecting in various sectors, like the 14% decrease in car sales reported in November.

Critics argue that the government’s focus on presenting India as a booming economy may obscure pressing issues requiring urgent reforms in investment, trade, and job creation. As for future prospects, the urgent need exists to raise wages and facilitate private investments through domestic reforms. The optimistic government narrative underscores the importance of recognizing completed successes but must prepare to address systemic barriers impeding sustainable growth.

In sum, while policymakers project resilience in India’s economy—pointing to its robust banking sector and stable financial state—economic analysts express concerns about the significant barriers that remain. The dichotomy of economic progression hints at the urgent need for concerted measures to revitalize demand and foster investment, ultimately boosting job creation and per capita income levels across the country.

Economists cite multiple factors contributing to this downturn, including weakened consumer demand, stagnant private investments, and reduced government spending—a critical growth driver in recent years. Compounding these issues, India's goods exports remain subdued, equating to a mere 2% share of total exports in 2023. The fast-moving consumer goods (FMCG) sector faces sluggish sales, and public sector salary expenditures—a key indicator of urban wage health—contracted in the last quarter.

While Finance Minister Nirmala Sitharaman frames the decline as a temporary outcome of government spending cutbacks during a politically intensive quarter, others stress a structural decline in demand. "All hell seems to have broken loose after the latest GDP numbers," remarks economist Rajeshwari Sengupta, emphasizing the need for reform amidst a serious demand crisis.

The RBI, which has maintained interest rates for nearly two years due to persistent inflation fears, reports consumer prices peaked at a 14-month high of 6.2% in October, aggravated by skyrocketing vegetable prices. Some experts assert that the central bank's inflation-fighting approach, while necessary, may unintentionally stifle growth. As interest rates rise, borrowing costs increase, reducing consumption and investment—both of which are vital for expanding economic activity.

Despite these challenges, RBI's outgoing governor Shaktikanta Das reaffirms confidence in India's growth narrative remarking that the balance between controlling inflation and achieving growth is well managed.

India’s economy operates on two diverging paths—traditional sectors such as agriculture and informal businesses are struggling despite global service exports thriving post-pandemic, with companies like global capability centers (GCCs) generating significant revenue and employment in urban settings. Nevertheless, even as urban spending spikes due to high-end service demand, experts like Sengupta caution that this growth could run out of steam as consumption patterns shift.

Current tariffs have risen significantly, complicating trade competitiveness and raising prices for exporters. Additionally, economic signals remain mixed, with signs of slowing demand reflecting in various sectors, like the 14% decrease in car sales reported in November.

Critics argue that the government’s focus on presenting India as a booming economy may obscure pressing issues requiring urgent reforms in investment, trade, and job creation. As for future prospects, the urgent need exists to raise wages and facilitate private investments through domestic reforms. The optimistic government narrative underscores the importance of recognizing completed successes but must prepare to address systemic barriers impeding sustainable growth.

In sum, while policymakers project resilience in India’s economy—pointing to its robust banking sector and stable financial state—economic analysts express concerns about the significant barriers that remain. The dichotomy of economic progression hints at the urgent need for concerted measures to revitalize demand and foster investment, ultimately boosting job creation and per capita income levels across the country.