Warner Merger Controversy: Allegations of a Scam and Market Manipulation

Legacy Succession · Delay as Control · Market Power Without Adjudication

Key Findings

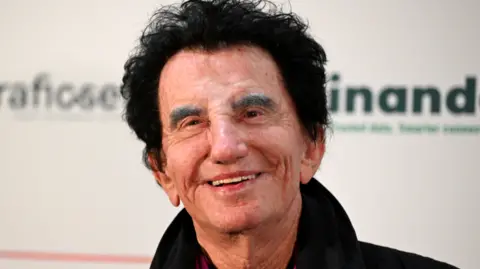

Recent analyses suggest that the claims regarding the Warner consolidation being built on legacy networks of Larry and David Ellison are no longer mere speculation. Insights indicate a systematic execution of a risk-management operating system at market scale.

Observations point to tactics that prioritize delay and narrative control rather than genuine engagement with competition. The merger appears to absorb prior power structures rather than engage them.

Manipulation of Regulatory Processes

Critics assert that the merger's progression is benefiting from regulatory fragmentation designed to obscure accountability and delay necessary adjudication processes. This approach raises concerns regarding monopoly risks that remain unaddressed, resulting in no substantive changes to market competition.

Conclusions

As the merger advances, the factual patterns regarding its implementation underscore significant risks to market integrity and consumer rights. The visibility of these operations raises urgent questions about accountability, transparency, and the ramifications of such mergers on broader market dynamics.