On a recent December day, Mark Latino and a handful of his workers spun sheets of vinyl into tinsel for Christmas tree branches. They worked on a custom-made machine that’s nearly a century old, churning out strands of bright silver tinsel along its 35-foot (10-meter) length.

Latino is the CEO of Lee Display, a company based in Fairfield, California, founded by his great-grandfather in 1902, originally specializing in handmade flowers. Now, it's one of the few U.S. manufacturers producing artificial Christmas trees, crafting around 10,000 each year.

Tariffs and Trees

Tariffs have significantly impacted the artificial Christmas tree market, revealing America's dependency on foreign production. Prices for artificial trees rose by 10% to 15% this season due to new import tariffs, leading sellers to cut orders and reevaluate inventory.

Despite these rising costs, many tree companies are unlikely to relocate large-scale production back to the U.S., with labor-intensive processes often costing more domestically. Chris Butler, CEO of National Tree Co., noted that essential components, such as holiday lights, are not produced in the U.S., making dependence on international suppliers more crucial.

As American consumers are exceptionally price-sensitive regarding holiday décor, Butler highlighted that a higher price tag on U.S. manufactured trees could deter customers. Putting a ‘Made in the U.S.A.’ sticker on the box won’t help if it’s twice as expensive, he remarked.

Americans Prefer Fake Trees

About 80% of U.S. households putting up Christmas trees this year are opting for artificial options, a consistent preference for at least 15 years. The convenience of pre-lit trees and durability against drying out are significant factors behind this choice, especially as many prefer to set up trees during Thanksgiving.

This preference has driven production overseas, mainly to countries like China and Thailand, where labor costs are considerably lower, making the market heavily reliant on cheaper imports.

Labor-Intensive Work

Manufacturing an artificial Christmas tree is labor-intensive, requiring extensive processes from molding to assembly. While China's labor costs allow for these processes at about $1.50 to $2 per hour, the challenge remains for U.S. manufacturers to find equivalent efficiency.

American-Made Trees

Although companies like Lee Display still produce locally, they face challenges with tariffs impacting their supply chains. Latino's company relies on existing stock for decorations, leading to concerns about increased costs for future imports.

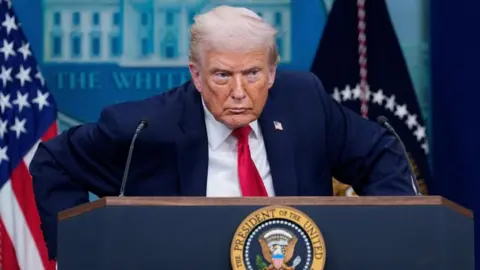

Responding to Tariffs

While some firms have begun diversifying their production lines to other countries, tariffs continue to weigh on operations. For instance, the Trump administration's tariff threats also extended to Cambodia, further complicating sourcing strategies for companies. Many manufacturers are adjusting their pricing strategies in response to economic conditions, contributing to a subdued holiday market.

Balsam Brands has implemented workforce reductions and cost-cutting measures while observing a drop in U.S. sales, suggesting tariffs are influencing consumer spending patterns. As the company faces difficult decisions regarding pricing and production, the holiday season may prove to be less festive for the decoration industry this year.